The average ratio of assets to liabilities is a critical metric in financial analysis that provides insights into a company’s financial health and solvency. This ratio helps stakeholders evaluate how well a company can meet its financial obligations using its available assets. Understanding this ratio is essential for investors, creditors, and financial analysts who want to make informed decisions.

In today’s competitive business environment, financial stability is crucial for long-term success. Companies that maintain a healthy asset-to-liability ratio are more likely to thrive, even during economic downturns. This ratio serves as a benchmark for assessing whether a company has enough assets to cover its liabilities.

This article will delve deep into the concept of the average ratio of assets to liabilities, its importance, and how it impacts financial decision-making. We’ll also explore practical examples, expert insights, and actionable tips to help you better understand this financial metric.

Read also:Nam Joohyuk Girlfriend Exploring The Love Life Of A Beloved Actor

Table of Contents

- Introduction to Asset-to-Liability Ratio

- How to Calculate the Average Ratio of Assets to Liabilities

- Why the Ratio Matters

- Interpreting the Ratio

- Industry-Specific Differences

- Optimizing the Ratio

- Case Study: Real-World Applications

- Common Mistakes to Avoid

- Tools for Analysis

- Conclusion

Introduction to Asset-to-Liability Ratio

What is the Average Ratio of Assets to Liabilities?

The average ratio of assets to liabilities is a financial metric that compares a company’s total assets to its total liabilities. This ratio provides a snapshot of the company’s financial position, indicating whether it has sufficient resources to meet its obligations. It is calculated by dividing total assets by total liabilities.

This ratio is particularly important for stakeholders who want to assess a company’s solvency and financial stability. A higher ratio generally indicates a stronger financial position, while a lower ratio may signal potential financial distress.

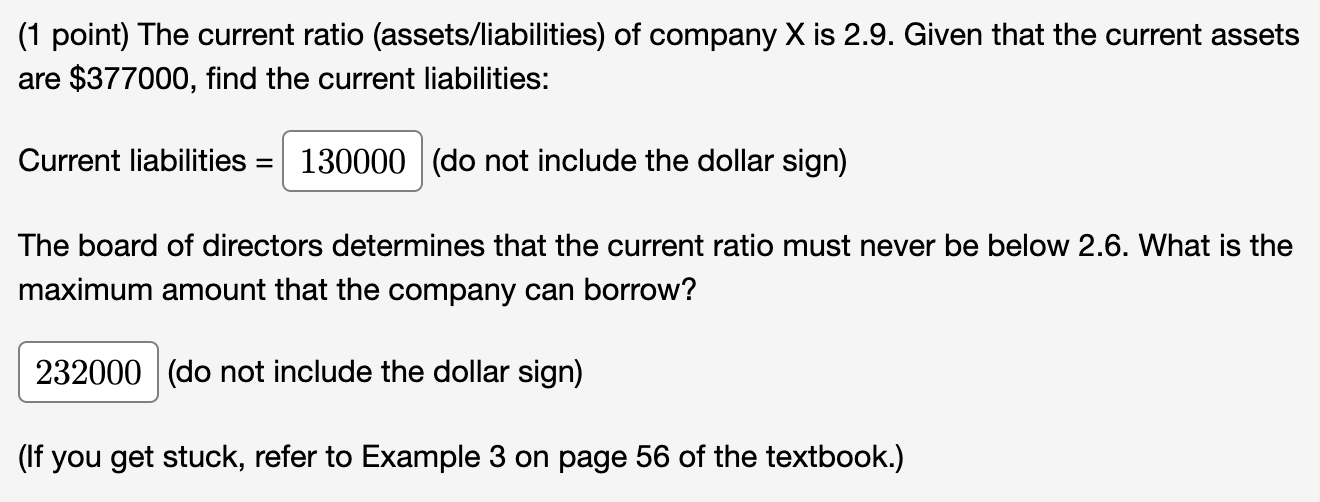

How to Calculate the Average Ratio of Assets to Liabilities

Calculating the average ratio of assets to liabilities is straightforward. Use the following formula:

Ratio = Total Assets ÷ Total Liabilities

For example, if a company has total assets of $1,000,000 and total liabilities of $500,000, the ratio would be:

Ratio = $1,000,000 ÷ $500,000 = 2

Read also:Alex Sampson Relationships Unveiling The Journey And Insights

This means the company has twice as many assets as liabilities, indicating a relatively healthy financial position.

Why the Ratio Matters

Assessing Financial Health

The average ratio of assets to liabilities is a key indicator of a company’s financial health. A high ratio suggests that the company has a strong asset base to cover its liabilities, reducing the risk of default. On the other hand, a low ratio may indicate potential financial instability, making it harder for the company to meet its obligations.

Investors and creditors often use this ratio to evaluate the risk associated with investing in or lending to a company. A company with a consistently high ratio is more likely to attract investment and secure favorable borrowing terms.

Interpreting the Ratio

Interpreting the average ratio of assets to liabilities requires context. While a higher ratio is generally favorable, the ideal ratio can vary depending on the industry and the company’s business model. For example, capital-intensive industries like manufacturing may have lower ratios due to higher fixed assets, while service-based industries may have higher ratios due to lower fixed costs.

It’s important to compare the ratio against industry benchmarks and historical data to gain meaningful insights. Additionally, consider other financial metrics, such as liquidity ratios and profitability indicators, to get a comprehensive view of the company’s financial health.

Industry-Specific Differences

Understanding Industry Variations

Not all industries are created equal when it comes to the average ratio of assets to liabilities. For instance:

- Manufacturing: Companies in this sector often have lower ratios due to high capital investments in equipment and infrastructure.

- Retail: Retail businesses typically have higher ratios because they rely on inventory and sales to generate revenue.

- Technology: Tech companies may have higher ratios due to their reliance on intellectual property and minimal fixed assets.

Understanding these differences is crucial for accurate analysis and comparison. Always consider industry norms when evaluating a company’s financial position.

Optimizing the Ratio

Strategies for Improvement

Companies can take several steps to improve their average ratio of assets to liabilities:

- Reduce Liabilities: Pay down high-interest debt and negotiate better terms with creditors.

- Grow Assets: Invest in revenue-generating opportunities and increase cash reserves.

- Improve Efficiency: Streamline operations to reduce costs and increase profitability.

Implementing these strategies requires a long-term commitment and a focus on sustainable growth. Regular financial analysis and strategic planning are essential for achieving optimal results.

Case Study: Real-World Applications

Example of a Successful Ratio Management

Consider the case of Company XYZ, a mid-sized manufacturing firm. By focusing on debt reduction and strategic investments, the company improved its average ratio of assets to liabilities from 1.5 to 2.5 over a five-year period. This improvement not only enhanced its financial stability but also attracted new investors and secured favorable borrowing terms.

This case study highlights the importance of proactive financial management and the positive impact it can have on a company’s bottom line.

Common Mistakes to Avoid

Pitfalls in Ratio Analysis

While the average ratio of assets to liabilities is a valuable tool, there are common mistakes to avoid:

- Ignoring Industry Context: Failing to consider industry-specific factors can lead to inaccurate conclusions.

- Overreliance on Ratios: Relying solely on this ratio without considering other financial metrics can provide an incomplete picture.

- Neglecting Long-Term Trends: Focusing on short-term fluctuations can obscure long-term trends and opportunities.

Avoiding these pitfalls requires a comprehensive approach to financial analysis and a commitment to continuous learning.

Tools for Analysis

Software and Resources

Several tools and resources can help you calculate and analyze the average ratio of assets to liabilities:

- Excel Spreadsheets: Simple and effective for basic calculations.

- Financial Software: Programs like QuickBooks and SAP offer advanced features for financial analysis.

- Online Calculators: Free tools available online can provide quick insights into the ratio.

Using these tools can streamline the analysis process and help you make more informed decisions.

Conclusion

The average ratio of assets to liabilities is a critical metric for assessing a company’s financial health and solvency. By understanding this ratio and its implications, stakeholders can make better-informed decisions about investments, lending, and financial planning.

To improve your understanding of this ratio, consider the following key takeaways:

- Calculate the ratio using the formula: Total Assets ÷ Total Liabilities.

- Interpret the ratio in the context of industry norms and historical data.

- Implement strategies to optimize the ratio, such as reducing liabilities and growing assets.

We encourage you to share your thoughts and insights in the comments section below. Additionally, explore other articles on our site for more in-depth financial analysis and expert advice. Together, let’s build a stronger financial future!